Introduction

UAE is currently the 3rd largest economy in the middle east region and 32nd on the global level with a GDP of $432 million, as of 2018. For years, the UAE economy was dependent on oil. But over the past decades, the country has shifted its focus towards non-oil sectors. Today, the United Arab Emirates is making headway as a significant incubator of technology startups. Interestingly, the country has the most active startup ecosystem, with 33 of the 50 most funded startups headquartered in the emirates. Saudi Arabia comes in second with seven startups. Abu Dhabi and Dubai have the largest number of Start-up companies in the UAE.

The business and political ecosystem of the UAE has helped enormous start-ups to thrive. Some of the factors for the success of start-ups in the UAE are its well-connected air and sea routes, government regulations, and its strategic location that connects the rest of the world with the developing Asian and African markets. In this article, we will explore what makes UAE a prime destination for starting up in the Middle East region.

Why is UAE an attractive destination for startups?

The UAE government is continuously striving to make UAE as an ideal place to start a new business. Some of the advantages include.

Stability & strategic location: The strategic geographic location of the country makes it ideal for new businesses as it connects several developing markets in Africa, South Asia, and the middle east. UAE also has a very low crime rate. UAE ranked in the top 50 countries with high political stability and the absence of violence in the world, according to the World Bank. All these aspects make the UAE a stable and secure place to start a business.

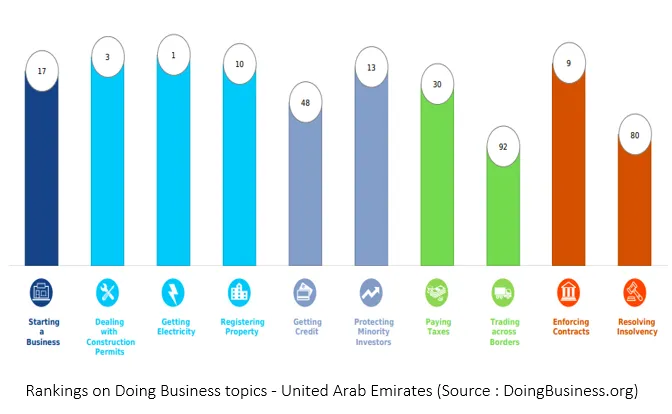

Ease of doing business: UAE stands 16th in the ease of doing business ranking in the world compared to 190 countries. The government has made steps to reduce the time required for obtaining a new electricity connection, obtaining construction permits easier, and introduced compensation for power outages. The transparency in the land registry makes registering new property simpler.

Strong business community support: For the past few years, UAE has been attracting entrepreneurs to start their business or expand their existing business. A survey conducted by Wamda showed that most of the entrepreneurs said that UAE is the preferred destination to start a business.

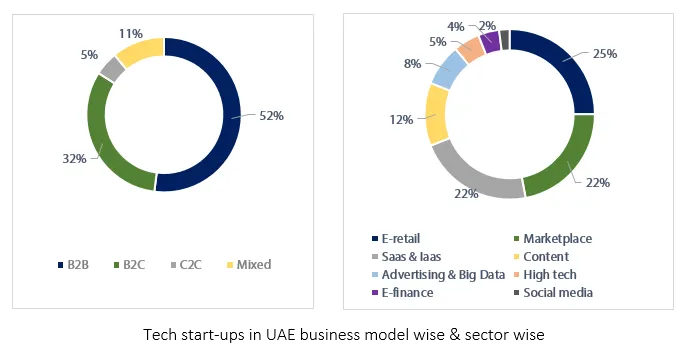

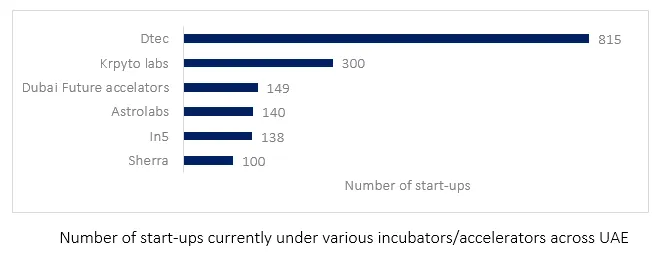

Digital transformations:The capacity and capability of the UAE government and private companies to spend money on technology have made UAE the forefront of digital transformation in the middle east. UAE is striving to provide an ecosystem ideal for entrepreneurs by increasing the number of co-working spaces, networking opportunities, training centres, accelerators, incubators, events, etc.

Variety in funding sources: UAE is ranked 25th in the Global Entrepreneur’s Index in the world, higher than any middle east countries. UAE being the financial capital of the region, prospect business can easily raise funds from cooperating venture capitalists, a private equity firm, venture capital firms, and angel investors in the middle east.

There has been an evolution in the attitude of venture capital funds in the UAE over the last few years.

Taxes: UAE offers relatively low taxes for operating SMEs. The country does not impose income taxes from companies except for foreign banks, production companies, and oil and gas companies. UAE has introduced a value-added tax of a minimal 5% for staples and healthcare industry.

Free Zones: UAE has over 45 free zones that have a variety of companies working in different sectors. The companies can follow the current mandate by the UAE, with at least 51% of the companies belongs to UAE nationals. Most of the free zones offer 50-years tax holidays and no import duties of products into the trade zones. This attraction makes the financial and regulatory environment and free zones a start-up hub.

Global competitive index: Global competitive index of UAE is 16 out of the 138 countries. It consists of various components institutions, market size, infrastructure, goods market efficiency, and macroeconomic environment.

Government Support for Startups launching in UAE

UAE has scored relatively high in various start-up indicators, making it a global front runner for entrepreneurship. Some of the initiatives include

- Full ownership of foreign-owned business: UAE government in 2019 has announced that entrepreneurs will have full ownership of the locally incorporated business. Previously, 51% of the stake had to be under UAE local. This move has been incorporated by the government to grant easy access to the UAE market.

- Bringing more tech business into UAE: The government of UAE has recently a tech hub, Hub 71, in partnership with Microsoft. The government has invested over 500 Million AED in the initiative to attract international talent to the country. To bring innovation in tech space, the government has announced a new accelerator program, Ghadan21 in which the government has invested over AED 50 Billion.

- Creating an environment favourable for working and living: UAE has been ranked 25th globally in the quality of life index. The country is ranked 9th for safety and security, making it an ideal location for entrepreneurs and their families. UAE has been ranked 16th in the ease of doing business index. The taxes imposed are minimal, and there are no requirements to submit returns for a variety of businesses. All these factors help in running the business smoothly in UAE.

- Extended visas for entrepreneurs: UAE government in 2018 started issuing five years visas to entrepreneurs looking to start a business in UAE. They should have capital of AED 500K or approval from an accredited incubator such as Hub 71.

The government of UAE in 2019 introduced 5- and 10-year residency visas for Non-UAE specialists and investors to study, work, and live in UAE without a local sponsor. - Offering funds and support for small business: UAE government are striving to provide support and help to start-ups and entrepreneurs. In 2019, the government of UAE has announced that 5% of the government capital will be allocated to SMEs to promote business in UAE. This initiative was launched by the government allowing SMEs in Dubai to receive over AED 400 million. The UAE government also announced that the SMEs working for government project be paid within 30 days to improve the liquidity of SMEs. In 2019, the UAE government announced that 20% of all the contacts of World Expo 2020 given to SMEs.

UAE laws attracting start-ups:

- Fees for over 1500 government service deducted or cancelled: To attract more start-ups, the UAE government has removed fees for over 50% of the 1500 government services. Some of these services are industrial business license, work permit, surveillance system licensing, registration of foreign subsidiaries, and renewal of security licenses.

- Abu Dhabi allocated over AED 535 Million for start-ups in Hub71: The fund is used to provide working space, health insurance, and accommodation subsidies for entrepreneurs. The subsidies are given to the start-ups in Hub71. For start-ups with less than five employees can get a 100% subsidy for two years and, those with 6-25 employees can get over 50% subsidy for three years.

RAG Business Group has been the pioneer in supporting start-ups in the UAE providing services like company formation, office space solutions, market research and feasibility studies and other business consulting services. RAG takes pride in launching some iconic brands in the UAE and continues to engage with MNCs, SMEs and Start-ups in the region providing services to launch new products, test new concepts, expand businesses to new regions and explore market potential. The RAG Business group is a team of widely experienced business consultants in the UAE providing solutions to business aspirants seeking opportunities to kick start a company in the UAE. Contact us Toll Free # 800724249 or write to: info@ragroup.ae to know how we can support you to set up a business in the United Arab Emirates.

June 14, 2025

تأسيس شركة في قطر بمساعدة مستشاري الأعمال

May 31, 2025

نظام الكفالة في قطر: دليل عملي للمستثمرين الأجانب

May 12, 2025

دراسة الجدوى في قطر: خطوتك الأولى نحو أعمال ناجحة

May 10, 2025

كيفية تسجيل شركة في المناطق الحرة بقطر: المتطلبات والإجراءات

April 26, 2025

رحلتك نحو الترابط العائلي في قطر تبدأ من هنا!

April 25, 2025

كيف تُسهّل خدمات العلاقات العامة رحلتك في تأسيس الأعمال في قطر؟

April 15, 2025

تأسيس الأعمال ببساطة: دور شركات الاستشارات التجارية في قطر

April 03, 2025

الملكية الأجنبية 100% في قطر: ثورة في عالم الأعمال

March 10, 2025

من المستهلك إلى القرار: أبحاث السوق بوابتك لفهم السوق القطري

February 28, 2025

كيف يسهّل مركز راج العالمي للأعمال عملية تأسيس الشركات في قطر؟

February 08, 2025

فهم دور خدمات العلاقات العامة في قطر: مفتاح لسلاسة العمليات التجارية

December 11, 2024

استكشاف مزايا تسجيل الشركات الجديدة في المناطق الحرة في قطر

November 26, 2024

أهم مزايا الاستعانة بمركز راج العالمي للأعمال لخدمات الكفيل المحلي في قطر

November 13, 2024

إطلاق العنان لإمكانات الأعمال: دليل أبحاث السوق في قطر

November 13, 2024

المتطلبات القانونية لتأسيس الشركات في قطر: نظرة شاملة

November 04, 2024

الملكية الأجنبية الكاملة في قطر: أبرز الفوائد للمستثمرين

October 24, 2024

كيف تستفيد من خدمات العلاقات العامة في قطر؟ دليل عملي خطوة بخطوة

July 17, 2024

كيفية الحصول على تأشيرة عمل إلى بولندا من قطر؟

April 03, 2023

تأسيس عمل ناجح في مجال الرعاية الصحية في قطر

July 01, 2025

A Recipe for Success: Starting a Restaurant Business in Qatar

December 06, 2022

كأس العالم لكرة القدم 2022: إنجاز تاريخي لقطر

June 01, 2021

تعرّف على شركة راج قطر وخدماتنا في الترجمة القانونية في قطر

November 15, 2020

الإمارات العربية المتحدة: قصة نجاح