Last updated in August 2025. Essential reading for Qatari investors and entrepreneurs.

Your company set up in Qatar in 2025 may be subject to fines of up to QAR 180,000 if you fail to file your taxes this year. As the new global minimum tax regulations take effect, many businesses are uncertain:

- Am I affected?

- Which setup option saves the most tax?

- What exactly must I do to stay compliant in Qatar?

This guide breaks it down without the jargon so you can confidently set up or run your Business Setup in Qatar 2025.

Quick takeaway: Qatar is still one of the most business-friendly countries worldwide, but compliance rules have become stricter. Let’s simplify what changed and how to adapt.

What Changed in Business setup in Qatar 2025: The Big Picture

1. The 15% Global Minimum Tax (for Large MNEs)

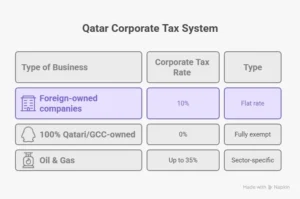

Qatar’s Law No. 22 of 2024 introduced a 15% global minimum tax in line with the OECD’s Pillar Two framework.

Who pays this?

- Multinational groups with consolidated revenue ≥ €750M

- Companies operating across multiple countries

Who doesn’t?

- 100% local Qatari or GCC-owned companies

- Small/medium businesses focused on the region

In short: Unless you’re a giant global enterprise, you still enjoy Qatar’s low 10% flat tax for your Business Setup in Qatar.

2. Extended Filing Deadline & Amnesty (for Large MNEs)

- New deadline: August 31, 2025 for 2024 returns

- Penalty relief: File by then and get a 100% penalty waiver

New Compliance Rules You Can’t Ignore

1. Economic Substance (CIGA Reporting)

- You must prove real business activities in Qatar (not just a registration).

- Examples: local management, decision-making, daily operations.

- Penalty: up to 15% of net income for non-compliance.

2. Expanded Permanent Establishment (PE)

Qatar now counts income earned without physical presence:

- Fixed place of business

- Service presence ≥183 days in a year

- Revenue linked to Qatar operations

3. Transfer Pricing Rules

- Mandatory documentation for related-party transactions.

- Thresholds: TP Declaration → ≥ QAR 10M Master/Local File → ≥ QAR 50M CbCR → ~QAR 3B revenue

4. The Dhareeba Portal (Digital Compliance Hub)

All tax activities now run through Dhareeba.

Deadlines to know:

- Tax return: 4 months post financial year

- WHT filing: 15th of next month

- Capital gains: 30 days from disposal

- Contract notifications: Mandatory

Penalties:

- Late filing → QAR 500/day (capped at QAR 180,000)

- Unpaid tax → 2% monthly penalty

- Missed contract notifications → per-contract fines

Even minor delays add up fast, automate compliance wherever possible to protect your Business Setup in Qatar 2025.

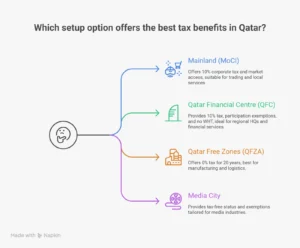

Tax Benefits by Jurisdiction

Common Tax Mistakes (And How to Avoid Them)

1. Remote Services Still Taxable

Even if 90% of work is offshore, Qatar-based activity triggers 5% withholding tax.

Solution: Document service locations clearly in contracts.

2. Forgetting Contract Notifications

Every contract must be reported to GTA.

Solution: Add it to your procurement workflow.

3. Foreign Income Pull-In

Qatar can tax dividends/interest/royalties received by residents.

Solution: Review holding structures for exposure.

4. Monthly WHT Rhythm

Withholding must be filed monthly, not quarterly.

Solution: Set up automated reminders.

Looking Ahead: What’s Next for Qatar

- VAT Coming Soon → Expected 5% under GCC framework.

- New Treaties Signed → UAE (2024), Saudi Arabia (2025).

- Digital Integration → Customs and tax systems are merging for real-time monitoring.

FAQs

1. Is VAT implemented in Qatar in 2025?

Not yet. Expected soon at 5% (similar to other GCC countries).

2. Do Qatar Free Zones still offer 0% tax under Pillar Two?

Yes, but large MNEs may face top-up tax under global minimum rules.

3. What happens if I miss Dhareeba deadlines?

You face daily penalties (up to QAR 180,000) and 2% monthly on unpaid tax.

4. Which is better: QFC or Free Zone?

- QFC suits holding companies & finance.

- Free Zones suit logistics, manufacturing, and media.

Both remain strong choices for Business Setup in Qatar 2025 depending on your industry.

Why Choose Us for Your Business Setup in Qatar

At RAG, we don’t just help you stay compliant, we turn tax rules into strategy.

We offer:

- Business setup in Qatar 2025: across all jurisdictions

- Transfer pricing & Pillar Two planning

- Dhareeba automation

- Contract & tax-efficient structuring

With deep local expertise + global perspective, we’ve helped companies from SMEs to global groups succeed in Qatar.

Ready to navigate Qatar’s new tax rules with confidence?